When I think of revenue streams for BESS (Battery Energy Storage Resources) I typically think of revenue stacking, tolls, etc. as described below. However, recent news included a project without contracted revenues in order to unleash the full monetization potential. In this article, I will address the various revenue streams for BESS.

Types of Revenue Stacking

- Resource Adequacy (RA) /capacity – Payments to ensure resources are available for a certain time period. Across the country, there are various RA constructs with a range of ways to ensure LSEs (load serving entities) have sufficient generation to cover peak demand as well as planning and operating reserves. There are various rules for how much each resource provides to that peak demand or metric for that utility or RTO. For example, in CAISO 4-hour batteries can get full resource adequacy credit.

- Energy Arbitrage – Great way to create revenue for BESS is charging the batteries for BESS when there are low electricity prices (pulling energy from the grid in typically off-peak hours) and then discharging the batteries (selling the stored energy to the grid) when prices are high (when energy demand is high typically on peak hours or when the sun goes down).

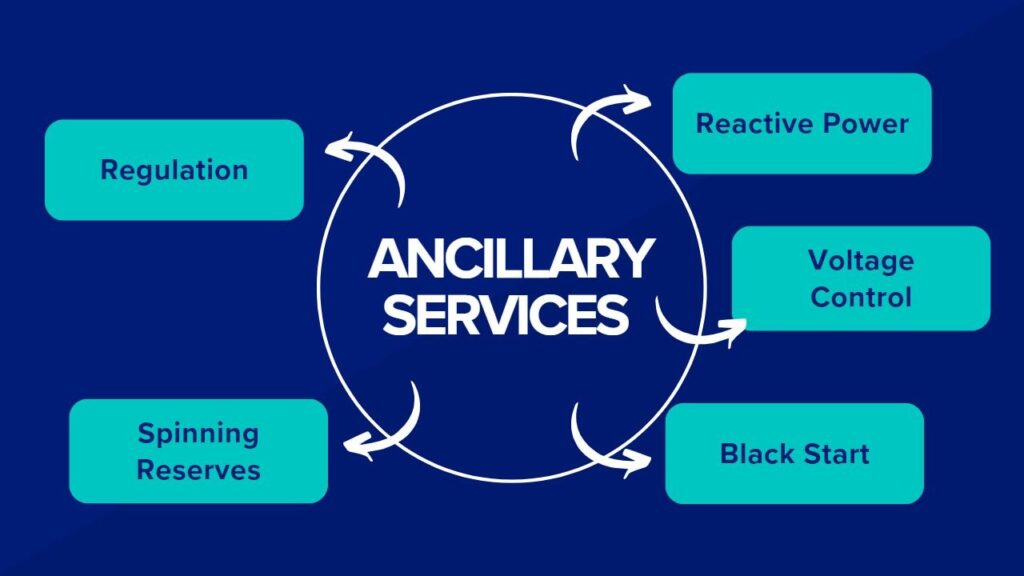

- Ancillary Services – Ancillary services are used as a power balancing service, to meet shortfalls in power, and to limit disturbances from the grid. They are the services necessary to support the transmission of electric power from generators to consumers given the obligations of control areas and transmission utilities within those control areas to maintain reliable operations of the interconnected transmission system.

- Regulation – BESS can provide regulation (seconds to minutes) that manages minute variations between generation and net load. Note: Net load is the difference between forecasted load and expected electricity production from variable generation resources (i.e. wind and solar).

- Spinning Reserves – BESS can provide other ancillary services such as spinning reserves for managing the difference between actual loads and generation within the hour. Spinning reserves are generation capacity that is on-line but unloaded and that can respond within 10 minutes to compensate for generation or transmission outages. “Frequency-responsive” spinning reserve responds within 10 seconds to maintain system frequency. Spinning reserves are the first type used when shortfalls occur.

- Reactive Power – By controlling the PCS (power conditioning system) connected to the BESS, reactive power can be provided at the level of the required local electrical system. Note: PCS for BESS is like an inverter for solar.

- Voltage Control – compensation for a generator to provide incremental voltage or to absorb voltage on the transmission system.

- Black Start – the restoration of electrical supply or restarting of conventional generating plant without use of external transmission resources or backup fossil fuel-based generation.

Tolling Agreement

Typically, a tolling agreement usually refers to a structure where the off-taker has full control over the dispatch of the project and determines how the revenues are earned through energy, capacity, and/or ancillary services.

I have read that others structure these tolling agreements between the project owner and the offtaker as denoted below:

- Capacity only

- Energy only

- Capacity and energy

- Other

Merchant Projects

In Feb 2023, unprecedented news was made on financed projects that were 100% merchant. It was the first use of IRA’s ITC for standalone projects. The financing comprised of developer equity along with tax equity. These merchant projects did not have offtake agreements, hedging contracts, or other contractual arrangements that would have guaranteed a portion of the revenue stack. The plan would take advantage of the full operation flexibly on how and when to dispatch these batteries.

What will be the future of BESS revenues?

TBD if we will see more merchant revenue projects. @Qcells USA Corp is developing over 6GWs of PV+S and over 7GWs of standalone BESS across the country. BESS has many advantages such as reducing renewable curtailment, backup power during outages and extreme weather events, load leveling and grid support. I look forward to working with industry experts to realize the value of BESS within RTOs, etc. as we proceed through the clean energy transition.

To read more blog posts from Amy Jo Miller, please see her blog here.

USA & Canada

USA & Canada Korea

Korea Germany

Germany United Kingdom

United Kingdom France

France Italy

Italy Netherlands

Netherlands Greece

Greece Poland

Poland Portugal

Portugal Hungary

Hungary Spain

Spain Japan

Japan