If you are thinking about load forecasting, your initial response may include a yawn. I admit I would not describe load forecasting as thrilling, but times may be changing.

In my 20-year energy career, I have seen a lot. Right now is an exceptionally exciting time for energy load forecasters due to the need for data centers, increased utilization of EVs, and so much more that increases electricity demand.

I came into the industry in 2005. Typical annual load growth assumptions were 1-3%. Then came the recession of the 2008-2009 era, when flat (meaning 0% load growth) was actually deemed positive news since many businesses were lost, leading to negative load growth in an area.

Now, we are in an exciting load forecasting world with examples such as these:

1. 4/30/24 –Texas’ grid manager increases its forecast for large-scale users from 111 GW to 152 GW, a 37% increase by 2030 due to demand from industrials, crypto, hydrogen, and data centers.

2. 5/2/24 A report predicts an influx of data centers, high-tech manufacturing, and building and transportation electrification measures will increase power demand by 30% in the Northwest over the next decade.

3. 5/8/24 – ISO-NE predicts New England’s peak load will increase by about 10% and electricity consumption by 17% by 2033, according to its 2024 Capacity, Energy, Loads and Transmission report. Hydro-Québec anticipates the region’s demand will double by 2050, while ISO-NE forecasts its peak load to reach up to 57 GW, compared to the 24-GW peak experienced in 2023.

Electrification, EVs, and new data centers are all reasons why electric load forecasting predictions are climbing higher than ever. With all of these increases in demand, what exactly is happening on the policy front to meet it? This article concludes by reviewing various policy initiative discussions for the load growth area of data centers in the most recent legislative sessions.

First, it is important to understand why there is a buzz about state policy and data centers. According to Boston Consulting Group, in September 2023, Data centers represented 2.5% of total U.S. power consumption in 2022, which is set to triple to 7.5% by 2030. Property consultants Newmark said in a January 2024 report that total demand from data centers will double to 35 GW by the end of the decade.

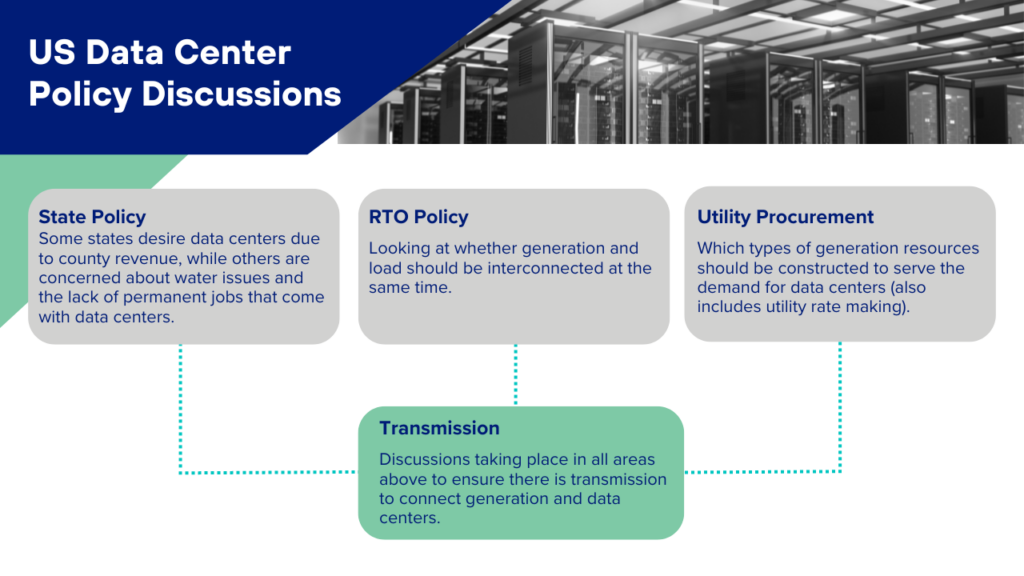

Let’s recap policy discussions around the United States regarding Data Centers and energy usage:

1. State Policy – some states have a desire for data centers due to county revenue while other states are concerned about water issues and lack of permanent jobs that come with data centers.

2. RTO Policy – looking at if generation and load should be interconnected at the same time.

3. Utility Procurement – which types of generation resources should be constructed to serve the demand for data centers (also includes utility rate making).

4. Transmission – discussions taking place in all 3 areas above to ensure there is transmission to connect generation and data centers.

What are your thoughts? What types of policies would you like to see due to data center growth?

To read more blog posts from Amy Jo Miller , please see her blog here.

To read other Qcells USA Corp. blogs, please go to https://us.qcells.com/utility/blog/.

USA & Canada

USA & Canada Korea

Korea Germany

Germany United Kingdom

United Kingdom France

France Italy

Italy Netherlands

Netherlands Greece

Greece Poland

Poland Portugal

Portugal Hungary

Hungary Spain

Spain Japan

Japan