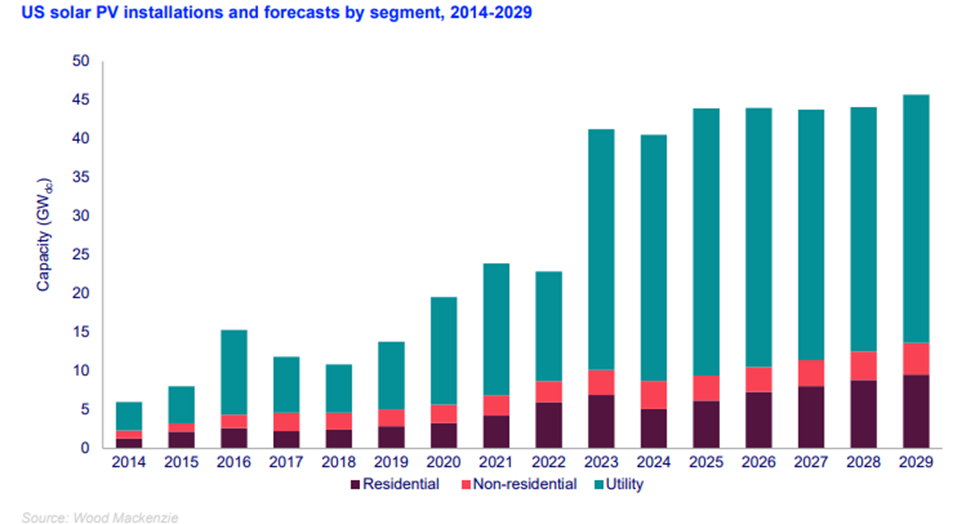

The solar industry is coming off a banner year, with record PV deployment across the United States. A recent report from the Federal Energy Regulatory Commission (FERC) showed that renewables accounted for nearly 90% of all new electrical generating capacity over a period from January to September last year, with solar contributing 78%. In a time of increasingly devastating natural disasters and rising energy costs, solar continues to offer a solution for its offtakers and the industry is on track for further expansion. According to research firm Wood Mackenzie, solar is projected to install at least 43 GW from 2025 onward, reaching a cumulative total of nearly 450 GW by 2029. And if history is any teacher, solar always outpaces its projections.

However, sustained growth presents challenges. The industry must still navigate equipment lead times, interconnection bottlenecks, and policy shifts. Efforts by companies like Qcells and others are mitigating these challenges within the domestic supply chain. Still, the future is bright (pun intended).

Market Trends in 2025

Let’s take a look at some of the market trends to look out for in the coming year below.

1. Data Center Demand

With the advent of artificial intelligence, data centers are here to stay and will further drive new energy demand. The Electric Power Research Institute (EPRI) estimates that data centers may grow to consume as much as 9% of U.S. electricity generation annually by 2030, compared to 4% today. These digital behemoths will continue to look for alternatives to directly pulling energy from the grid. Renewables will play a strong role in powering these hyperscalers through activities like colocation of off-grid resources and power purchase agreements (PPAs). They will do so not just because they are clean and renewable, but because they are cost-effective and easily dispatchable.

2. TPO on the Rise

The Fed has continued its trend of lowering interest rates in recent months. However, recent jobs numbers and a trend toward 2% expected inflation could push the Fed toward a more neutral posture. Sustained interest rates would create market conditions that make third-party ownership (TPO) more attractive to consumers. In these TPO arrangements, upfront costs and associated loans are replaced by agreements that offer consumers more attractive electricity rates.

3. Solar + Storage

State-level net metering dynamics are shifting the financial incentives for residential solar, placing more emphasis on storage. Last year, Wood Mackenzie saw a record 28% of solar installations paired with storage, with rates continuing to grow as states and utilities grapple with factors like dynamic rate structures and load balancing. This trend underscores the critical role that storage will play in the future solar nationwide.

4. Domestic Manufacturing

As we transition to a new administration, we still expect a focus on domestic clean energy manufacturing with solar energy as the cornerstone of this effort. As the leader in the U.S. for silicon-based module production, Qcells continues to advocate for the domestic supply chain, introducing ingot, wafer, cell and finished module production at its new Cartersville, GA facility by 2025. The new solar supply chain factory will become the largest facility of its kind in the Western Hemisphere. Demand for domestically produced solar components is set to remain strong, driving further industry investment.

5. Perovskite Breakthroughs

Solar technology is at an inflection point, and perovskites are on everyone’s mind. These tandem cells (named for their use in conjunction with traditional solar cells) have the ability to push the limits of solar module efficiency. Where traditional modules peak on average around 20-23% PV conversion efficiency, perovskites can absorb a wider range of the sun’s energy, enabling tandem cells to reach theoretical limits of greater than 40% efficiency. This creates new opportunities for increased energy output and cost reduction. As luck (and years of R&D) would have it, Qcells recently achieved a new world record, reaching 28.6% for tandem solar cell efficiency on a cell scalable for mass production. Expect more tandem technology announcements from across the industry in the months to come.

Conclusion

Looking ahead, the solar industry is poised for continued growth. Technological advancements, coupled with increasing demand and supportive policies, will drive greater innovation and deployment. As costs continue to decline and efficiency improves, solar power will play an increasingly vital role in transitioning to a clean energy future.

USA & Canada

USA & Canada Korea

Korea Germany

Germany United Kingdom

United Kingdom France

France Italy

Italy Netherlands

Netherlands Greece

Greece Poland

Poland Portugal

Portugal Hungary

Hungary Spain

Spain Japan

Japan